Josh Luber is the dream personified.

Born and raised in Philly, the 41-year-old entrepreneur managed to turn a childhood passion into a multi-million dollar, global venture through tried and true methods that’d make your folks proud. The son of a dental hygienist mother and lawyer father, Luber’s parents “instilled in [him] an appreciation for the importance of education and have always been supportive of [his] entrepreneurial endeavors.” That is: after going to undergrad business school at Emory in Atlanta, he followed it with a joint law degree and MBA there, all the while starting and selling several different business ventures.

Now, not only is he fully self-made but the father of two leads an entire empire as the CEO of StockX, the Detroit-based sneaker industry stock market.

Just days before our interview, StockX launched its first IPO with Ben Baller Did the Chain, a pair of slides offered exclusively on the platform. The results were astounding, as over 10,000 users bid to own one of the 800 pairs released. Offers ranged from $50 to $1 million; for sneaker geeks and the business curious alike, the results are a fascinating study.

The success of StockX only adds fuel to Luber’s ever-growing wildfire of aspirations, which, as he’ll explain, aren’t impossible. The Hundreds interviewed Luber to gain valuable insight into the practical leaps of faith that got him to the top of his game.

How He Got Into Sneakers:

I literally have the exact same stories as everyone else my age which is I grew up playing basketball. I always wanted Air Jordans. My mom would never buy me Air Jordans. I got my first job and got my first pair. For me, it’s all about Nike basketball — posters of Spike Lee, Michael Jordan, Mars Blackmon, and Bo Jackson, and all the old Nike stars.

But I started three other startups before StockX. None of them had anything to do with sneakers, almost intentionally so. I avoided creating any business that was related to sneakers, almost out of fear that it was just an excuse to play with sneakers. Growing up, [internet] entrepreneurs didn’t exist. The path was linear: school, grad school, then you become a doctor or lawyer or [get into] business.

It’s not a coincidence the business that was, in retrospect, the most successful is one where I finally joined my personal passions with business.

How His Other Startups Led to StockX:

My first company was called Tech Experts. It was like Geek Squad before Geek Squad — we would go to people’s houses and fix their computers. I actually sold that business to another competitor in the space before I went to grad school. After grad school, I started Servinity, which was basically online scheduling for restaurant staff. This was in 2006 — pre-iPhone, pre-app. Then there was a side business around a company called Turntable.fm, which was this music startup and we built businesses around that. The business that would become StockX was a company called Campless, which was a price guide for sneakers.

How a Day Job Helped Him Start StockX:

In between every one of my startups, there was always some version of a corporate job as a placeholder. If you’re a typical entrepreneur and you’re 150 percent in, then whatever happens — you sell the company, it goes out of business or anything in between — you never have time to transition plan. There’s no notice if you’re the founder of the company. You’re running as fast as you can, and you run into a wall and it ends however it ends. I’m fortunate to have a good academic background and resume to go work in [corporate]. After I shut down Servinity at the crash of 2008/09, I took a job with IBM as a strategy consultant and moved from Atlanta to New York.

It’s not a coincidence the business that was … the most successful is one where I finally joined my personal passions with business.

How Luber Realized He Could Monetize His Sneaker Passion:

I fucked with sneakers ever since I was 8-years-old. I still have shoes that I wore in seventh grade. There have only been three really big monumental changes in the sneaker industry. The first was in 1985 with the first Jordan. The second was 1999/2000, with early internet and eBay, which made it an underground global thing. The third was in 2011/2012 with the [advent] of Instagram and social media really exposing sneakers to a much wider audience. At the end of 2011, you had the last time Jordan released the Jordan 11 Concord and February 2012 was the NBA All Star Weekend in Orlando with the Galaxy release and Nike selling those on Twitter. Now, the industry is back in the headlines for the first time in 15 years because of riots and people killing each other for sneakers. It was right around that time I wondered what are the businesses in this area. It was really just me not seeing any real analytics around the sneaker industry. I just happened to choose this one area where there’s no one else doing it at that moment. It also coincided, in retrospect, with Facebook buying Instagram. That’s all sneakerheads ever wanted to do: see what shoes other people were wearing and show off their [collection].

How Entrepreneur Gary Vaynerchuk Validated His Career Path:

The first time I met Gary was right when we were starting StockX. It was in a very packed New York lunch counter and we were sitting side by side — we couldn’t have been any closer to each other. The first thing he said to me ever, and he’s like three years older than me, was, “Baseball cards or candy?” I paused for a second and I was like, “Both.” I used to find baseball cards up until I was a sophomore in high school. I used to sell chewing gum in sixth grade and blow-pops in ninth grade. Those were the hustles for entrepreneurial-minded kids back when Gary and I were [teens]. It was before the internet. Now kids are hustling making apps or selling sneakers because sites like StockX can make it easy.

How His Motivation Changed Over the Years:

It’s more obsessive. The more success you have at this level, it just begets more. Now it’s worse than it’s ever been. I sleep usually about three or four hours a night. The availability of cell phones and texts and having everything at your hands basically doesn’t let me ever disconnect. All I ever want to be doing is working and I know that’s not necessarily the best thing, but it is what it is.

Ideas are worthless. Execution is the only thing that matters.

[As for routine] I usually take two naps a day. I usually sleep at 3 or 4, usually wake up between 7 and 8. I have a couch next to my desk and I take one 11-minute nap sometime in the afternoon at work. Then everyone will just leave me alone. Then I usually take a second nap at home. I’ll fall asleep in my daughter’s bed and take another half-hour nap putting her to sleep. Then I get up, eat some dinner, and go work another couple hours. Four hours and 41 minutes of sleep a day.

How He’s Growing StockX:

First is geographically, we can continue to sell the same things we sell in other markets. We opened up an office in London in Q4 2018. This year is a lot about growth in Europe. We just hired our first person in Japan, so Asia will be a focus as well. Second is by adding a new product category. One of the categories we’re probably going to add next is art — things that are serialized like prints, collectible toys, and skate and street art. Third, it’s really about being an alternate retail channel, to do more IPOs.

From the very beginning, the whole idea of StockX was to create a marketplace that was based on how the stock market works. If the IPO of a company happens, then that same market continues to trade. It’s one market that blurs the line between what is retail and what is resale. The concept of retail/resale price going away in the stock market is just one number. It’s whatever the true market value is. The idea was always that this could be the way to do that for consumer goods. So for us, the Ben Baller IPO was huge because on one hand it just looks like a fun slide with Ben, but it’s really about how we released that and seeing the results. We sold 800 pairs using what’s called a blind dutch auction, which had never been done before. Our hypothesis is that is how super-hyped, limited products should be released, as opposed to today, where a retail price is placed on a product that has no bearing on the value of it. You take a pair of Off-White Jordan 1s and they retail for $190, then get resold for $2000. [That method] relies on mass chaos and people paying off people that work at the store and bots and campouts to redistribute product that has a value that’s significantly more than what you’re originally selling it for.

[Ultimately] it’s about access. Most of these products aren’t products that you can walk into the store and buy, so for most people, you’re never going to have an opportunity to buy them. StockX is just about access at every single level.

How the Current Streetwear Hustle Affected His Approach to Business:

[Seeing kids in line for a limited release] is just a fabulous testament to this old world and it’s comical. It’s comical that you rely on having people lineup at a sneaker store for three days to get a pair and by the way, usually, if you see a campout line like that, more than half the people in line are being paid by someone else to be there. It’s an antiquated system. The IPO process is more fair and easier — everything about it.

Luber’s Advice for Business Success:

There are two pieces of advice I always give: One is talking to everybody about everything. Don’t ever think someone’s gonna steal your idea or ask someone to sign an NDA to talk to you. Ideas are worthless. Execution is the only thing that matters. Two, do something. There are so many people sitting around thinking they have to come up with the perfect idea. Just start. You just have to be doing something to move forward even if you’re not exactly sure why.

StockX is just about access at every single level.

How Giving Back Is Crucial to His Business:

My business partner is Dan Gilbert, who’s dealing with the Cleveland Cavaliers and Quicken Loans, the largest mortgage lender in the United States. As a company under the Quicken Loans Family of Companies umbrella, we’re tied into an organization that has a mission, that has diversity inclusion, and that has community service teams. What was interesting about us in particular around the charity stuff is we were able to use what we do well, which is selling sneakers online to raise charity. It’s not like we went out and did something that was completely out of our lane. We were fortunate to know and meet a lot of very high profile people. They have sneakers that people wanted, so we were able to create online charity events and raised over one million dollars for charity by selling a pretty small number of sneakers. When Eminem gives you a pair of Carhartts or Pharrell gives you a pair of the NMD Human Race, those go for a lot of money. It really has been a good thing that we consciously take advantage of.

***

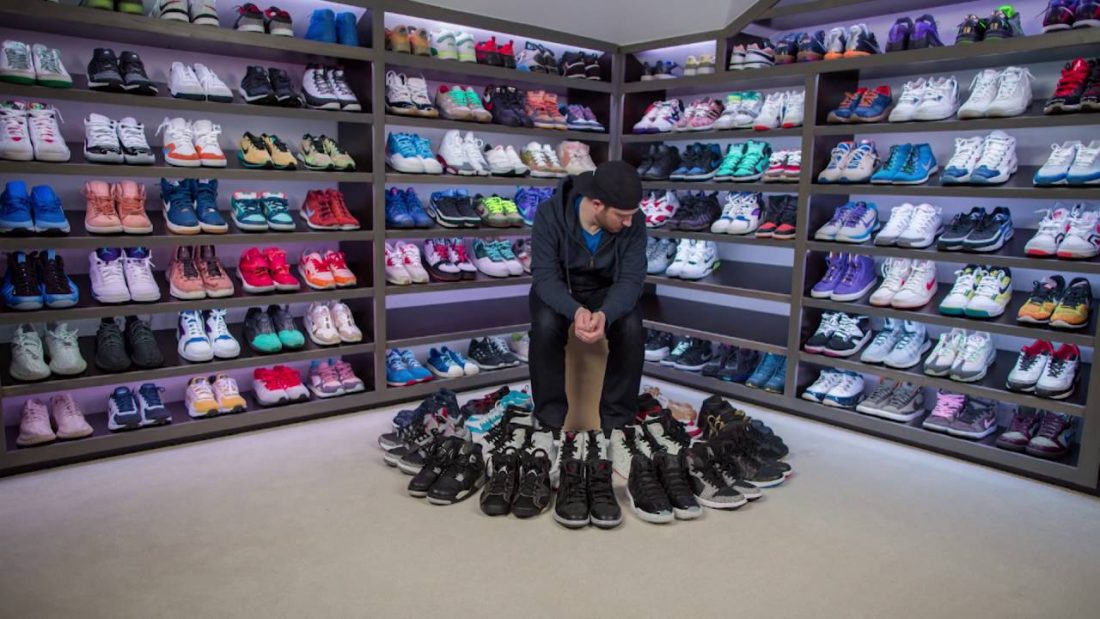

Header photo by Graham Walzer